Maximizing Your Euro Savings: Unlock 2.7% Daily Interest with Revolut

Maximizing Your Euro Savings: Unlock 2.7% Daily Interest with Revolut

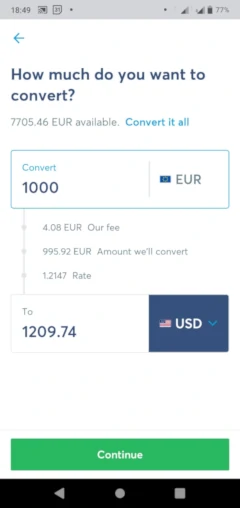

Maximize your Euro and save on high conversion fees as you exchange it for USD.

Did you know that converting your EUR to USD can now be done through a fast, safe, easy, and affordable means? Yes, that’s right! In this article, we’ll talk about how you can convert your Euros to US dollars safely and easily through an efficient platform with fair exchange rates. This way you meet your personal goals and save money too.

Because the good news is, affordable and innovative solutions are readily available on the market, we just might be missing out on it. And the best part is, you can start today.

So if you’re tired of the long lines at the bank or the money changer and the high fees and rates connected to their services, this article is for you.

For the longest time, currency exchange is found to be expensive. Even more so when it’s between strong and stable currencies recognized for its purchasing power. Like converting the Euro to US Dollars.

Why? Because among other factors, money converters also make the most of the business opportunities available from it through large service fees on top of the exchange rate. A lot of what we pay goes to service fees and unnecessary charges that don’t even live up to the service offered.

Doing business is not a bad thing but a business has to serve the customer too, not just its interests. After all, making a profit and saving on money is a universal goal.

Additionally, the expense of foreign currency exchange also comes in the form of frequent use from activities in business and travel. Personal needs are involved too, like sending money from abroad back to your hometown or when you make online purchases on your favorite e-commerce store.

That’s why businessmen, tourists, professionals, and everyone else in between - like you and me - are always looking for the best ways to convert our money. Because it’s only through the best ways that we get to maximize what we have, save on cash, and most importantly meet our goals and needs.

So how do we get to the other side where both forex and customers get to have their cake and eat it too?

Let’s answer those questions with a quick rundown of key concepts. Understanding how things work will help you grasp why they do what they do.

Eventually, this knowledge will give you the sound judgment to choose the best means to convert your Euros to US Dollars.

If a picture is worth a thousand words, are a thousand Euros worth a thousand dollars?

Yes! The answer is a resounding yes and even more.

How? That’s where economics comes into play.

In the simplest sense, foreign exchange rates are determined by the value of each country’s currency. This value is influenced by major factors like the examples below and its comparison to one another in the foreign exchange market.

After bringing all of these factors together, the value of the country’s currency is then called its floating rate. Major economic powerhouses like the United States and Europe use a floating rate to value their currencies. At the end of the day, it’s really about the flow of supply and demand for the currency.

There is also such a thing called a fixed rate. Fixed rates are when governments’ central banks rate their currencies against another’s like Saudi Arabia’s to the US Dollar and most countries in Africa to the Euro.

The factors mentioned above is how rates are determined in the foreign exchange (forex) market. This is where currencies are bought or sold by comparing the value of one to another. Participants like the everyday trader, banks, companies, brokers, and firms partake in these activities to serve the interests of their businesses or personal goals.

You’ll see here how much of one currency is needed to buy another and how much of another currency you’ll get as you sell yours. A similar activity is in play when you buy or sell currencies at the bank, your local money changer, or through electronic money institutions.

To give a deeper purpose to what you already have about converting the EUR to USD, let me share an interesting fact.

Did you know that the Euro and the US Dollar are the most heavily traded currencies in the world? That’s because these two represent the world’s largest economies and serve as the world’s top two reserve currencies.

These distinctions are anchored to positive correlations that influence its values, like stable governments and robust economies. These make the Euro and the US Dollar viable currencies to be traded and also helps determine the price of the EUR/USD pair.

Hence the case for currency converters including them in their roster of currencies for exchange.

Sometimes, a fresh perspective is needed to change the way we think about things. As our perspective changes, our actions change as well.

So here’s another interesting fact to give you that much needed fresh air. Did you know that not only is the EUR to USD the most heavily traded pair, they’re also the most widely available currencies for exchange?

Every currency converter you go to will have a EUR to USD and US Dollar to Euro in their offerings. It’s out there widely available in your most trusted financial institutions and also in the safest most innovative online platforms.

So with all of the great things going for the Euro amidst all the challenges, one euro is still worth a thousand dollars and more. As you convert your EUR to USD, maximize its potential while saving on service fees and high exchange rates. All you have to do is to change the way you change your money.

Here’s how.

We’re all familiar with these financial institutions that convert your EUR to USD anytime and any day. It’s true that they’re all great but in this article, let’s focus on one game changer - electronic money institutions.

Where can you change EUR to USD?

The European Central Bank (ECB) defines ELMIs as credit institutions authorized to issue electronic money and provide services related to it. Services such as issuing electronic money legally considered as payment, online payment processing, lower exchange rates, efficient money transfers from country to country, and easier account opening.

Now that you’re familiar with ELMIs, it would be a good idea to familiarize yourself with the electronic money issued by these institutions.

It’s essentially digital money considered as legal tender. It’s safe and real.

Please take note though that ELMIs aren’t banks. They’re institutions that offer another side of financial services that are just as safe and efficient as the bank. To give you further peace of mind, the safety of their services are overseen by a regulatory body like the Financial Conduct Authority in the United Kingdom.

You can also read more about the ECB’s in-depth working papers about ELMIs here:

Change the way you think about currency exchange with this list of top 5 ELMIs.

Top 6 ELMIs:

To give you more reasons to switch, electronic money institutions like WISE virtual bank account are game changers because of the wide range of products offered, the competitive rates they give, and the innovative technology supporting their platforms.

Not to mention the ease in account opening.

These benefits are possible because of simplified regulations governing these institutions such as WISE.

All you have to do is to maximize their EUR to USD conversion services and say yes. You’ll get the fairest exchange rate of them all while enjoying a lot of benefits on the side too.

Here’s why.

WISE is an electronic money institution that enables you to send money across the board with the most competitive exchange rates. They also provide accounts in multi-currencies that widen the possibility of what you can do in the platform.

Send money back home, receive and make payments from anywhere in the world, and travel without worrying if you’ve got the right currency in your pocket. All with fair and accurate exchange rates. WISE meets both your personal banking currency needs and business banking currency needs in one outstanding platform.

And most of all, you get to save money because WISE has no hidden fees. What better way to maximize the EUR to USD conversion process, right?

WISE has no hidden fees and is also 8x cheaper than the rest of the players in the conversion game. They charge their fees upfront so you’d already know what you’re paying for because in all of WISE’s activities, transparency is the key.

With WISE, you can truly see that your Euro is worth a thousand dollars and more.

So make the switch, get started with WISE and change the way you think about money.

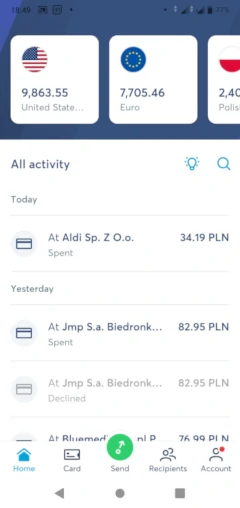

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and USD among others, and convert your EUR to USD or your USD to EUR at anytime with a few clicks and some of the world’s lowest fees?

This is possible with the WISE service, that is a free multicurrency transfer and currencies holding system. Creating an account is free, currency conversion rates are transparent and usually the market lowest, and you can order a Master debit card for postage price, around 5€, or get a free virtual visa card, and pay locally in any currency you hold.

If you do own currencies on which you are trying to pay, there will be no payment fee. If you don’t, it will use your main currency wallet to pay with lowest possible conversion fees.

Open your multi-currency account for free and try the service for yourself!

The EUR currency symbol is the letter € that can be accessed with European keyboards using the key combination AltGR+E.

To use the icon in your documents, presentations or web pages, use the Font Awesome Euro sign icon.

Font Awesome Euro sign icon code: fas fa-euro-sign | \f153

Euro currency symbol: €

The USD currency symbol is the letter $ and can be accessed on most keyboards using the appropriate letter.

To use the icon in your documents, presentations or web pages, use the Font Awesome Dollar sign icon.

Font Awesome Dollar sign icon code: fas fa-dollar-sign | \f155

US Dollar currency symbol: $

The conversion rate change between EUR and USD currencies is constantly changing, and every day and month has a different average value. However, these historical values can help you check recent historical changes to the EUR to USD rate with below chart and table.