Currency Conversion in Revolut Euros to Dollars

- Revolut - an international card for ample opportunities: converting euros to dollars

- Convertible currencies to Revolut

- Main functions of the application

- Standard (free)

- Premium (about 7 euros per month)

- Metal (about 11 euros per month)

- How to use Revolut to convert and convert Euros to dollars?

- Why is the Revolut app considered better than others?

- Which account is better to use: euro or dollar?

- Cons of the multifunctional card Revolut

- Frequently Asked Questions

This article tells about the pros and cons of the multifunctional Revolut card, as well as how to use it to convert euros into dollars without any particular difficulties and losses.

Revolut - an international card for ample opportunities: converting euros to dollars

Revolut was originally created by the Visa and MasterCard collaboration. The idea was to get a universal card that could be used to pay around the world without bothering to convert money. For example, a Russian tourist went to Poland, he has rubles on the map, but the Polish currency is zlotys. How to pay? Just like in Russia. I came, I saw, I paid. And if in real life all existing banks take 1.5% of the operation at the Central Bank rate, in Revolution there is an exchange without this commission, that is, at the exchange rate. Therefore, the deviation in the exchange is obtained only by hundredths of a percent. Since there are no trades on the stock exchange on weekends, the application takes a commission of 0.5%. In order to receive all these privileges, you need to be an EU resident.

You can even pay with a card online, and it doesn't matter what currency is on it, everything will be exchanged automatically when the transaction is made. There is a free tariff, according to which 200 euros are available for withdrawing cash from an ATM, then 2% is taken for each operation. But it still comes out more profitable than purposefully changing money.

Convertible currencies to Revolut

Conversion is a currency exchange when conducting transactions with a bank card or account. It is required if the currencies of the sender and recipient are different. For example, it occurs when paying for a purchase in a foreign store.

Currency convertibility is if residents and non-residents (foreigners) have the right to exchange it in unlimited quantities for another currency or banking metals. This right is usually guaranteed by the central bank of the country in which the currency circulates.In fact, the list is huge and very impressive. Therefore, it is worth highlighting the most basic and popular currencies, and vice versa - illiquid ones.

Convertible Currency Definition – InvestopediaPopular include:

- Czech koruna, euro, dollar, Polish zloty: used to create wallets and replenish them by bank transfer;

- Czech koruna, euro, zloty, dollar, Polish zloty: used to create wallets and replenish them with a card online;

- Belarusian ruble, Czech koruna, Kazakhstani tenge, zloty, Russian ruble, yuan, dollar, Polish zloty: used to pay for purchases and services, withdraw cash from ATMs, and more.

Main functions of the application

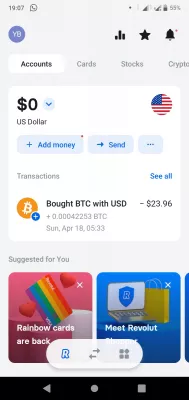

The application is controlled only from a mobile device. In the application, you can create wallets in the desired currencies, replenish them, view completed transactions.

In addition to these buns, there is a Cards tab. This is probably the most interesting part of the application. In a couple of clicks, you can create virtual cards for free, the creation of the first plastic card is free, but you will have to pay 6 euros for delivery. But the second real card will also cost 6 euros. You can not only open cards, but also block them with one click.

The security features in this application are original and particularly useful. For example, there is a geo-referencing function: if the cardholder's phone is located far from the place of making a purchase or paying for something, the operation will be refused. You can also prohibit contactless transactions, or turn on a ban on online purchases. In general, each function is designed to ensure that people enjoy using the application.

Standard (free)

- Free account, over 150 currencies

- Exchange up to 4700 euros per month without commission

- Withdrawals from ATMs up to 190 euros per month without commission

Premium (about 7 euros per month)

- Free account, over 150 currencies

- Exchange up to 4700 euros per month without commission

- Withdrawals from ATMs up to 380 euros per month without commission

- Medical insurance abroad

- Flight delay and baggage loss insurance

- Express delivery of the card worldwide

- Access to 5 cryptocurrencies

- Disposable virtual cards

- Access to the VIP lounges system at the airports Lounge Key

Metal (about 11 euros per month)

- Free account, over 150 currencies

- Exchange up to 4700 euros per month without commission

- Withdrawals from ATMs up to 570 euros without commission

- Medical insurance abroad

- Flight delay and baggage loss insurance

- Express delivery of the card worldwide

- Access to 5 cryptocurrencies

- Disposable virtual cards

- Access to the VIP lounges system at the airports Lounge Key

- Cashback 0.1% for transactions in Europe and 1% for transactions outside of it

- Concierge service

How to use Revolut to convert and convert Euros to dollars?

Everything is very simple.

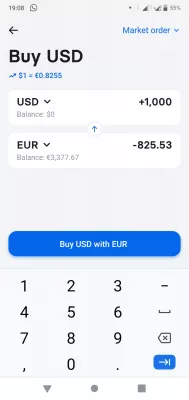

- Download the Revolut app.

- Create a wallet in euro currency.

- Top up it with any available bank card or bank transfer.

- Create a wallet in dollar currency.

- Now there is a card in the application with the conversion of euros to dollars.

You can repeat these steps an unlimited number of times with any available currencies, and there are more than 150 of them.

Why is the Revolut app considered better than others?

Cheapest EUR To USD Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and USD among others, and convert your EUR to USD or your USD to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration

This application has a lot of useful functions, the main of which is the conversion of money at the exchange rate. Of course, there are also commissions here, for example, on an illiquid currency (the Russian ruble used to belong here), or on a weekend when the exchange is closed.

There are also security settings that will really help keep funds safe and not be afraid that someone else might use them.

Revolut is, in principle, the only application of its kind, the only one that functions normally, since it is the result of a collaboration between Visa and MasterCard. It was created in order to be beneficial to people and for people to use it. Those who have used this application at least once understand how much money they have lost in their entire life during an ordinary currency exchange, and how much benefit they received using Revolut.

Another huge advantage is the ability to bind the card to Apple and Android Pay, that is, the ability to carry the card with you all the time and lose it completely disappears. The application with the same account can be installed for all family members, they can use it completely free of charge and legally, and if one of the phones is lost, it is possible to completely block the cards from the other and prevent the leakage of finances.

Which account is better to use: euro or dollar?

In principle, both of these currencies are popular in the Revolution, both of them can be used to create and replenish wallets, to recharge online and to withdraw cash, as well as other available services.

Since the creation of an account is completely free, and there are more than 150 currencies available, you can afford to open one account in euros, the other in dollars, absolutely free. And then use the money, as it is convenient.

Cons of the multifunctional card Revolut

To open an account, you need to live or have a long-term national visa, or live in the territory of the European Union. This is a minus for tourists, but a plus for those who have DNV, because the application can be used almost without restrictions, even with a basic subscription level.

In the Revolution there is such a thing as illiquid currency. Previously, they included the Russian ruble, and now the hryvnia (1%) and the Thai baht (1.5%). That's all the cons.

Frequently Asked Questions

- How does Revolut ensure competitive rates for Euro to Dollar conversions, and are there any additional fees involved?

- Revolut typically offers currency conversion rates close to the interbank rate, ensuring competitive rates for Euro to Dollar conversions. They aim to minimize additional fees, though some minimal fees may apply during weekends or for certain types of accounts.

Cheapest EUR To USD Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and USD among others, and convert your EUR to USD or your USD to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration