Is Payoneer Better Than Paypal To Handle USD To EUR Payments?

- Is Payoneer better than PayPal? Table with transaction comparison: commissions down from more than 7% with PayPal to less than 1% with Payoneer + WISEBusiness

- PayPal fees for USD to EUR payment

- Full cost breakdown of receiving a $100+ payment with PayPal

- Payoneer fees for USD to EUR payment

- Full cost breakdown of receiving a $500+ payment with Payoneer commission based fee

- Full cost breakdown of receiving a $800+ payment with Payoneer fixed fee

- Is Payoneer better than PayPal?

- How to pay less transfer fees with Payoneer or PayPal... using WISEBusiness?

- Transferring USD remains of a Payoneer commission based payment to EUR

- Transferring USD remains of a Payoneer fixed payment to EUR

- In conclusion: how to get most EUR for USD payments

- Frequently Asked Questions

Having a company based in Europe, reporting income in EUR, and paying taxes in EUR, but receiving various payments in USD:

- for creating online courses in USD by my courses publishing partner MMC based in San Diego, CA, USA;

- from websites optimized display ads from Ezoic based in Carlsbad, CA, USA,

- for publishing guest posts on my websites.

I do receive mostly US dollars that I then have to convert to EUR for reporting by my company, to calculate and pay taxes, and later for personal spending after all that.

Most of these partners offer the choice to be paid in USD either via PayPal or Payoneer, and it is usually difficult to understand how to get the most Euros from US Dollars earnings after two various fees: the transfer fee resulting from direct payment, and the conversion fee for transfer these USD to EUR on my local accounts.

Ezoic payment methodsIs Payoneer better than PayPal? Table with transaction comparison: commissions down from more than 7% with PayPal to less than 1% with Payoneer + WISEBusiness

The full table shows these differences, and what are the best choices for freelancers and other international workers to get paid in US Dollars and transfer their clients payments to Euros:

Let's have a look at what happens with both Payoneer and PayPal and try to understand which is better to handle such transactions in detail, with examples for each possibility.

PayPal fees for USD to EUR payment

The commission is difficult to understand, and might not make sense at first. Actually, after years of using PayPal service and receiving various payments, from a few dollars to up to thousand dollars, it is never clear how the amount is calculated and why is it so high.

PayPal Consumer FeesIf you can make sense of the PayPal fees for your USD to EUR incoming payments, please let us know in details.

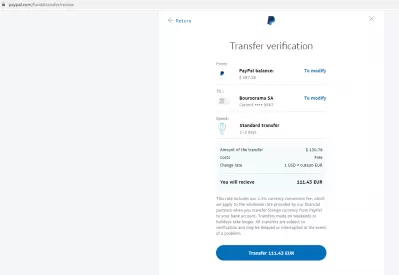

Full cost breakdown of receiving a $100+ payment with PayPal

Taking the example of a payment received for a guest post via PayPal of $135, we can see on the PayPal receipt that a commission is taken right away on the received payment.

For low amounts like this one, the amount was down to about 3.13%, but it can go as high as 5% for larger amounts.

But that's not it! Once your incoming USD payment has been received on your PayPal account, you still have to withdraw it to your local EUR bank account, where you will finally be able to pay taxes and eventually spend what is left of it.

And there is where magic happens: they claim that the USD to EUR transfer is free of charge, but they apply in fact a terrible transfer rate.

On the day of our check, the difference was nearly 4%, which makes finally the PayPal currency conversion fee exist at 4%.

The total final fee for using PayPal is therefore at least 7%, meaning that when using PayPal service to handle USD payments in your EUR account, you only receive 93% of your hard-earned money with their hidden fees.

Payoneer fees for USD to EUR payment

On Payoneer service, there are two types of incoming payment fees, which are very different:

- $3 fixed fee for payments from registered Payoneer accounts,

- 3% commission fee for payments from external accounts.

Therefore, the more you are working with registered Payoneer businesses, the less you are paying in terms of percentage on the final bill.

Let's have a look at one example of each.

Full cost breakdown of receiving a $500+ payment with Payoneer commission based fee

With a fixed 3% commission fee for incoming payments on Payoneer, the costs of using their services are clear - and they can even be lowered down by switching to a fixed commission from registered partners payments, as we will see later.

However, this commission is clear and simple to understand, making it easy to plan business income in advance and understand where our money goes.

Once the USD payment has arrived in your Payoneer USD account, it is possible to withdraw it to a registered EUR bank account, just like it is the case with PayPal.

However, here, the full cost of conversion is less than 2%, including both the transfer rate fee and the transfer fee.

At the end, the finaly transfer fee is a little under 2%, far below the PayPal conversion fee. and the total cost of receiving EUR from USD payment using only Payoneer goes down to a little more than 5%, already a far better option.

Full cost breakdown of receiving a $800+ payment with Payoneer fixed fee

Dealing with a registered business however is a totally different story, as the only fee is a fixed $3 commission for a USD incoming payment, getting lower in terms of percentage as you grow your business and earn more from your partners.

Cheapest EUR To USD Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and USD among others, and convert your EUR to USD or your USD to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration

This commission is even easier to account for and understand, as it doesn't change, regardless of you are earning only a few dollars, or thousands of dollars at a time from a single transaction.

And after having received your payment with a low $3 fee, the same commission and transfer fee is applied to the USD to EUR withdrawal to bank account of 2%, as it was the case with a Payoneer commission-based fee.

At the end, comparing the final account transferred in the EUR bank account to the initial USD payment, the whole commission is only a little over 2%, thus making it the best choice so far to receive payments.

Is Payoneer better than PayPal?

According to our above check, of various payments received on both services with different configurations, the commission paid on Payoneer can be as low as 2.34% including fees, while in PayPal it does not go below 7%.

We can then easily say that Payoneer is better than PayPal. But let's not stop there: can we get even more Euros in our company bank account from the same inital customer payments? Yes, that is the case!

It is even possible to manage full USD to EUR incoming payments with a total commission of less than 1%. Let's see how in detail!

How to pay less transfer fees with Payoneer or PayPal... using WISEBusiness?

After having received payment on Payoneer, it is possible to use their credit card to pay for international money transfer and avoid any other transfer fee by using an external money transfer service such as TransferWise.

However, this operation is simply not possible with PayPal, due to the fact that they only transfer money to other registered bank accounts, and that it is not possible to use their credit card (as they don't have one!) to transfer the money.

Let's see how it works, and how we can save even more money.

Transferring USD remains of a Payoneer commission based payment to EUR

Using this trick, it is possible to transfer money received from a commission-based payment on Payoneer to a EUR bank account using fees and commissions from a low cost money transfer service, such as WISEBusiness.

Simply go on their website, create a free business account, and start a money transfer, from USD to EUR. Using the option to pay with a debit card, and by using your Payoneer credit card, you will benefit from even lower transfer fees.

In this case, with a received payment of $500.8 on Payoneer after payment fees, it is possible to receive as much as 434.91€, or a conversion fee of 1.72% and a total commission on the whole transaction of 4.86%.

Transferring USD remains of a Payoneer fixed payment to EUR

Using payment received from a registered business on Payoneer, as the amount is higher, the conversion commission is even lower, getting as low as 1.61%!

The same process applies, after having created a free account with WISEBusiness: simply start a new transfer, enter the amount to transfer, and pay with your Payoneer credit card - and that's it!

The final commission on this whole transfer, using a registered Payoneer business for the initial USD payment and WISEBusiness to transfer it to your bank account and convert it to EUR, is less than 2%, by far the best option!

In conclusion: how to get most EUR for USD payments

If you cannot get paid directly on your own bank account in your own currency, there will most likely be various fees and commissions involved, some of them hidden, and some of them openly stated.

However, for the same payment from your partner, receiving incoming payments on Payoneer is better than Paypal in any case, getting the commission on the whole transaction from 7% with PayPal to 5% with Payoneer, and it is even more profitable if the paying business is registered on Payoneer, thus benefiting from a low fixed fee of $3, and getting the while commission down to 1.78% - or it can even get lower on larger amounts.

And if you can do so, finalizing the incoming USD payment by converting it to EUR and transferring it to your bank account with WISEBusiness will get the whole transaction fee down to less than 2%, the best option possible.

To go even further, open accounts with the following services, all free to use:

- Payoneer account to handle incoming payments,

- WISEBusiness account to handle USD to EUR conversions, and clients payments if available,

- RevolutBusiness account to handle clients payments if available.

Frequently Asked Questions

- What advantages does Payoneer offer over PayPal for USD to EUR transactions in terms of fees and exchange rates?

- Payoneer typically offers lower fees and better exchange rates compared to PayPal for USD to EUR transactions. Payoneer's fee structure is more transparent, and its exchange rates are often closer to the mid-market rate, making it a cost-effective option.

Michel Pinson is a Travel enthusiast and Content Creator. Merging passion for education and exploration, he iscommitted to sharing knowledge and inspiring others through captivating educational content. Bringing the world closer together by empowering individuals with global expertise and a sense of wanderlust.

Cheapest EUR To USD Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and USD among others, and convert your EUR to USD or your USD to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration