How To Issue A European Invoice For The Import Of US Services

- The concept of VAT

- EU VAT regulation

- Taxable transactions

- Determination of the place of provision of services for VAT purposes

- Place of provision of B2B services

- Place of provision of B2C services

- Practical examples

- Example #1.

- Example #2.

- Example #3

- Rules for calculating and paying VAT (B2B services)

- EU Service Provider - Has a VAT number. Customer (recipient) of services The same EU country - There is a VAT number

- EU Service Provider - Has a VAT number. Another EU country. Customer (recipient) of services - There is a VAT number

- EU Service Provider - Has a VAT number. Customer (recipient) of services Other EU country - No VAT number

- Non-EU Service Provider - No VAT number. Customer (recipient) of EU services - Has a VAT number

- EU Service Provider - Has a VAT number. Customer (recipient) of services Non-EU - No VAT number

- Frequently Asked Questions

The concept of VAT

Value Added Tax (VAT) - value added tax (VAT) is a widely used form of taxation in various countries added during the production and distribution of the value of a product or service. The amount of tax received by the manufacturer (seller) is paid to the budget, but minus the amount of tax included in the prices of goods or services purchased by him earlier. VAT is an indirect tax, since the amount of tax is included in the cost of goods (services) and is paid upon purchase by the consumer to the seller, who, in turn, pays the tax to the state.

In fact, VAT US is a kind of surcharge on the cost of goods. As a rule, the business does not pay it itself, but issues an invoice to the final buyer. The amount of tax is calculated based on the difference between the cost of goods and its selling price. The money goes to the treasury along the chain: from the initial stage of production to the final sale to the buyer.

Since hereinafter we will focus specifically on the value added tax in the European Union, the abbreviation “VAT” will be used to denote it in order to reflect the specifics of the European VAT compared to similar indirect taxes (for example, Russian VAT).

The majority of companies doing business in the EU countries, as well as their partners (suppliers, customers, intermediaries) from other countries, including Russia and the CIS, face the value added tax levied in the EU. At the same time, the different terminology and administration rules of the European VAT, compared to the Russian one, causes inevitable difficulties, which in some cases are preferable to resolve with the help of European specialists in the field of taxation and accounting.

However, the general principles for levying VAT on common types of commercial transactions can be understood by looking at the provisions of the relevant EU directives. This article proposes to consider such rules on the example of operations for the provision of services.

EU VAT regulation

At the level of the European Union, there is a single (supranational) regulation of the procedure for establishing and collecting this tax. The basic document regulating the procedure for VAT taxation in the EU is Directive 2006/112/EC of November 28, 2006 On the common system of value added tax. This Directive defines all the key elements of VAT taxation, with the exception of tax rates that are set by each individual EU state (within the limits established by the directive) and some other issues.

European VAT rules and rates: standard, special & reduced ratesTaxable transactions

For VAT purposes, there are 4 types of taxable transactions:

- Goods supply;

- Purchase of goods within the Community;

- Provision of services;

- Import of goods.

Services rendered by taxable persons to each other are called “B2B services”. Services provided by taxable persons to non-taxable persons are referred to as “B2C services”. These services have different rules for determining where they are provided.

Determination of the place of provision of services for VAT purposes

When it comes to the provision of services, the place of taxation is the place where these services are provided (the place where these services are provided). However, in order to determine which country will be the place of provision of the service 9a, respectively, the rules and conditions for calculating and paying VAT), it is necessary to establish:

- Type (category) of the service provided;

- Location of each party;

- Entrepreneurial status of the customer (recipient) of the service – whether he is an entrepreneur and a VAT/VAT taxpayer or not.

Consider the rules established by EU law for determining the place of supply of services for VAT purposes, paying attention to cases of cross-border provision of services.

Place of provision of B2B services

As a general rule, B2B services, that is, services provided by business entities to each other, are subject to VAT at the location of the customer (recipient) of the services.

According to Art. 44 of the directive, the place of supply of services to a taxable person is the location of this person (the place where the business of this person is established / located), that is, the customer of the services. However, if such services are provided to a taxable person's permanent establishment located at a place other than its seat, the place of supply of the services will be the location of the permanent establishment.

Place of provision of B2C services

As a general rule, B2C services, that is, services provided to private individuals, are subject to VAT at the location of the supplier.

According to Art. 45 of the directive, the place of supply of services to non-taxable persons is the location of the supplier (the place where the supplier's business is established / located). However, if such services are provided by the supplier's permanent establishment, the place of performance of such services will be the location of the permanent establishment.

Practical examples

Consider a few examples where a British company (private limited company) or a limited liability partnership (LLP) provides consulting (as well as legal, accounting or auditing) services to other companies, both residents and non-residents of the EU.

EU - Value Added Tax (VAT) - International Trade AdministrationConsulting/legal/accounting/auditing services provided by an English company to other taxable persons engaged in entrepreneurial activities (both residents and non-residents of the EU) are classified as “B2B” services.

For such services, the general rule of Art. 44 of the Directive, according to which the provision of B2B services is subject to VAT at the location of the customer (recipient) of the services.

Example #1.

The service provider is a UK company and the service recipient is a company from another EU side.

Option A. The recipient of the services is an EU company (other than English) with a VAT number. For example, consulting services provided by an English company to a Cypriot company are subject to Cypriot VAT (because the location of the recipient of the service is Cyprus).

At the same time, VAT is not included in the price by the English service provider (on invoices (invoices) issued to the recipient, only a note containing the VAT number of the counterparty and the inscription reverse charge can be made, which will indicate the recipient's obligation to report VAT in his country). In other words, the obligation to report VAT in this case is assigned to the company receiving the service (provided that it has a VAT number).

Cheapest EUR To USD Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and USD among others, and convert your EUR to USD or your USD to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration

The recipient of the service calculates VAT under the reverse charge procedure. The reverse charge procedure means that the customer of the service, when submitting a VAT return (VAT Return) in his country, puts the local VAT for payment and at the same time puts the same amount of VAT for deduction. The result is zero, meaning that no tax is actually paid on the transaction.

However, in order to use this opportunity, the recipient of the service must be a relevant business person, that is: firstly, be a taxable person in the sense of Art. 9 Directives; secondly, it must be registered for VAT (have a VAT number) in an EU Member State. The recipient of the service must first inform the supplier of his individual VAT identification number, and the supplier must check the validity of this number and the associated information about the counterparty.

Option B. The recipient of the services is an EU company (other than English), but without a VAT number.

If the recipient of the service (EU company) does not have a VAT number, then VAT must be included in the price for the recipient (the invoice must include VAT) and paid by the supplier in his country (with the possibility of further deduction).

Example #2.

Both the supplier and the recipient of the services are English companies with a VAT number.

If an English company provides services to another English company, then VAT is included in the price (invoiced with VAT), and paid by the supplier (with the possibility of further deduction).

Example #3

The service provider is a UK company and the service recipient is a non-EU company.

For example, an English company provides legal services for a Russian company (according to the rule of Article 44 of the Directive, the Russian Federation is considered the place of provision of services), English VAT is not subject to accrual (invoices are issued without VAT).

In other words, if the recipient of the service is a non-EU company and does not have a VAT number, then VAT should not be included in the price.

However, this is only possible if these relationships qualify as B2B, that is, the recipient of the service must necessarily be a taxable business entity, which must have some kind of confirmation.

The supplier may consider a customer registered outside the EU as a business entity if:

- If the supplier receives from the customer a certificate (certificate) issued by the competent tax authority of the customer's country as confirmation that the customer is engaged in economic activity; or

- If the customer does not have such a certificate (certificate), but the supplier knows the VAT number, or a similar number assigned to the customer in the country of its registration and used to identify business entities, or any other evidence demonstrating that the customer is an entrepreneur, and provided that that the supplier has reasonably verified the accuracy of the information provided by the customer.

In other cases, if there is no evidence that the recipient of the service (non-EU resident) has an entrepreneurial status in his country, the transaction will be classified as B2C, and the location of the supplier will be the place of taxation.

Therefore, if the business status of the recipient of the service is not entirely clear, then such customers are (by default) invoiced with VAT, and the tax is paid by the supplier in their country (with the possibility of further deduction).

Rules for calculating and paying VAT (B2B services)

EU Service Provider - Has a VAT number. Customer (recipient) of services The same EU country - There is a VAT number

VAT is included in the price (invoices are issued with VAT). Paid by the supplier at the rate of their country (with the possibility of further deduction).

EU Service Provider - Has a VAT number. Another EU country. Customer (recipient) of services - There is a VAT number

VAT is not included in the price (invoices are issued without VAT). VAT is not actually paid. The recipient of the service reports on VAT at the rate of his/her EU country (“reverse charge” mechanism).

EU Service Provider - Has a VAT number. Customer (recipient) of services Other EU country - No VAT number

VAT is included in the price (invoices are issued with VAT). Paid by the supplier at the rate of their country (with the possibility of further deduction).

Non-EU Service Provider - No VAT number. Customer (recipient) of EU services - Has a VAT number

VAT is not actually paid. The recipient of the service reports on VAT at the rate of his/her EU country (“reverse charge” mechanism).

EU Service Provider - Has a VAT number. Customer (recipient) of services Non-EU - No VAT number

VAT is not included in the price (invoices are issued without VAT) only on condition of a confirmed entrepreneurial status of a non-EU resident customer. Otherwise, invoices are issued with VAT.

Frequently Asked Questions

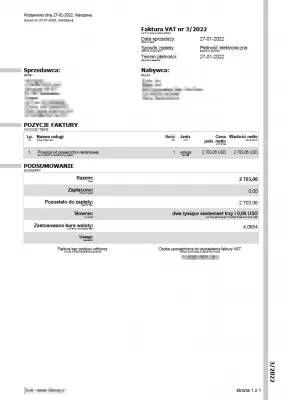

- What are the key components to include in a European invoice for the import of US services to ensure legal compliance?

- A European invoice for the import of US services should include details like the service description, total amount payable, VAT if applicable, currency (EUR or USD), payment terms, and legal information about both the service provider and the recipient.

Cheapest EUR To USD Exchange With No Hidden Fees

Did you know that you can easily open a multicurrency account on which you can hold many currencies, such as EUR and USD among others, and convert your EUR to USD or your USD to EUR at anytime with a few clicks and some of the world’s lowest fees?

Free registration